Services

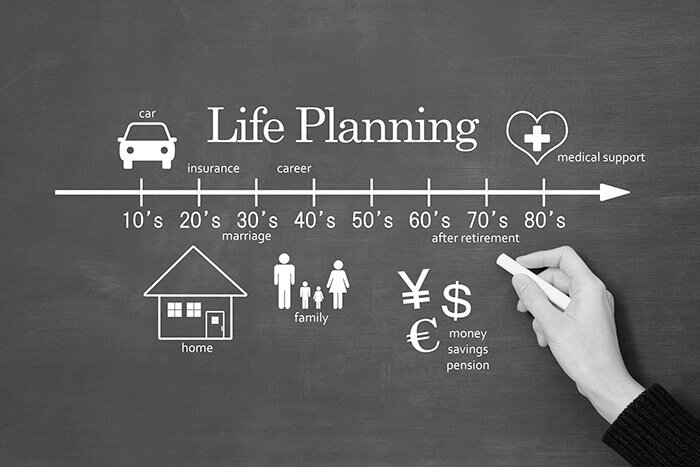

Innovation. Efficiency. Resilience. Sustainability. Collaboration. These are the hallmarks of great companies thriving in the 21st century. Like you, we believe that people do their best work when they believe their lifetime goals are being met, encouraged and enhanced by the companies they work for and dedicate themselves.

And it’s true…

The most successful companies create alignment with their employees’ values by focusing on the higher purpose of achieving a social good — one such example is helping them to, one day, retire successfully.

Investment Analytics Services

Proven Process

Our proven process allows us to act in either a 3(21) investment advisor or 3(38) investment manager capacity based on your preference. We establish a prudent process to ensure you have the proper investments for your retirement plan. The process starts with learning about your organization’s demographics, culture and goals. From there we help identify the appropriate investment categories to offer within your plan, and we will make specific recommendations on investment options. We then design and implement an Investment Policy Statement and monitor the investments going forward.

Investment Analytics Services

Proven Process

Our proven process allows us to act in either a 3(21) investment advisor or 3(38) investment manager capacity based on your preference. We establish a prudent process to ensure you have the proper investments for your retirement plan. The process starts with learning about your organization’s demographics, culture and goals. From there we help identify the appropriate investment categories to offer within your plan, and we will make specific recommendations on investment options. We then design and implement an Investment Policy Statement and monitor the investments going forward.

Quarterly Review and Report

Quarterly, our internal investment committee reviews and analyzes investments in each plan. We provide a detailed report to you to communicate our findings. We have a rigorous process to identify and replace underperforming investments. We also annually benchmark your plan for fees to ensure the proper fee structure.

Executive Summary

We also create an executive summary, which is aesthetically pleasing and easy to understand. We are always willing to bring you through our process and explain our analytics, but we realize sometimes clients appreciate the abridged version because they have other business priorities.

We also offer:

Develop, implement and monitor Investment Policy Statements

Create and monitor “Watch List” for underperforming investments, if applicable

Capital market and economic update

Meetings with investment committee

Investment monitoring and reporting

Research and risk analysis by our internal investment committee

Investment manager and mutual fund industry updates

Fiduciary Governance Services

Held To The Highest Standard

Most likely, you were not awake last night worried about fiduciary risk. So, although we mitigate risk for you, the real exciting part is that we become your advocate. Alpha Pension Group will serve in a fiduciary capacity to your retirement plan. What exactly does this mean?

We are held to the highest standard under law: the fiduciary standard. We must put you and your employees’ interest before our own. We help you understand your responsibilities today and then thoroughly explain your considerations for tomorrow. We help you raise the standard for your company, your retirement plan and most importantly…your employees.

Annual benchmarking of fees, services and plan statistics to measure plan effectiveness

RFP services, for no additional fee

Deliver an online secure portal for important documents

A plan manager for daily administrative needs

Comprehensive vendor review to ensure competitiveness of fees and services

Create and maintain a fiduciary audit file and checklist to fulfill fiduciary duties

Plan design, legislative, compliance and industry updates

Employee Retirement Plan Education

Unbiased Education

Everyone in your workforce – every level of employee – will have access to our unbiased education and guidance – in a comfortable, nurturing environment. Our philosophy: this is not wealth management…this is wealth creation.

- We meet at your level and help elevate your unique plan. Whether you are just getting started, or are a seasoned pro, our experts will use language and analogies designed for each person’s point of reference

- We help each member build wealth regardless if their account balance is $1,000 or $10,000,000

- We provide sincere, information-based education and guidance

- We do not sell annuities, life insurance, or anything else, which means we can focus on our philosophy

Employee Retirement Plan Education

Unbiased Education

Everyone in your workforce – every level of employee – will have access to our unbiased education and guidance – in a comfortable, nurturing environment. Our philosophy: this is not wealth management…this is wealth creation.

- We meet at your level and help elevate your unique plan. Whether you are just getting started, or are a seasoned pro, our experts will use language and analogies designed for each person’s point of reference

- We help each member build wealth regardless if their account balance is $1,000 or $10,000,000

- We provide sincere, information-based education and guidance

- We do not sell annuities, life insurance, or anything else, which means we can focus on our philosophy

Education Platforms

We use every medium available to connect and educate on your schedule:

- Group meetings held at your office at the best time for you

- Individual meetings held at your office or over the phone

- On-demand webinars based on desired content

- Live, monthly educational webinars with our Director of Education Services

- Two-minute educational videos customized to your population

- Printed fliers and paycheck stuffers

Education Content

Our content has the breadth and depth to help all who need it including:

- Retirement Foundations

- Market Volatility

- Plan Changes

- Pre-Tax Versus Roth

- Financial Independence

- The Power of Compounding

- Budgeting

- Debt Reduction

- College Savings

- Supporting Children and Elderly Parents

- Nearing Retirement

- Social Security

- Medicare